Swing Trading Strategies

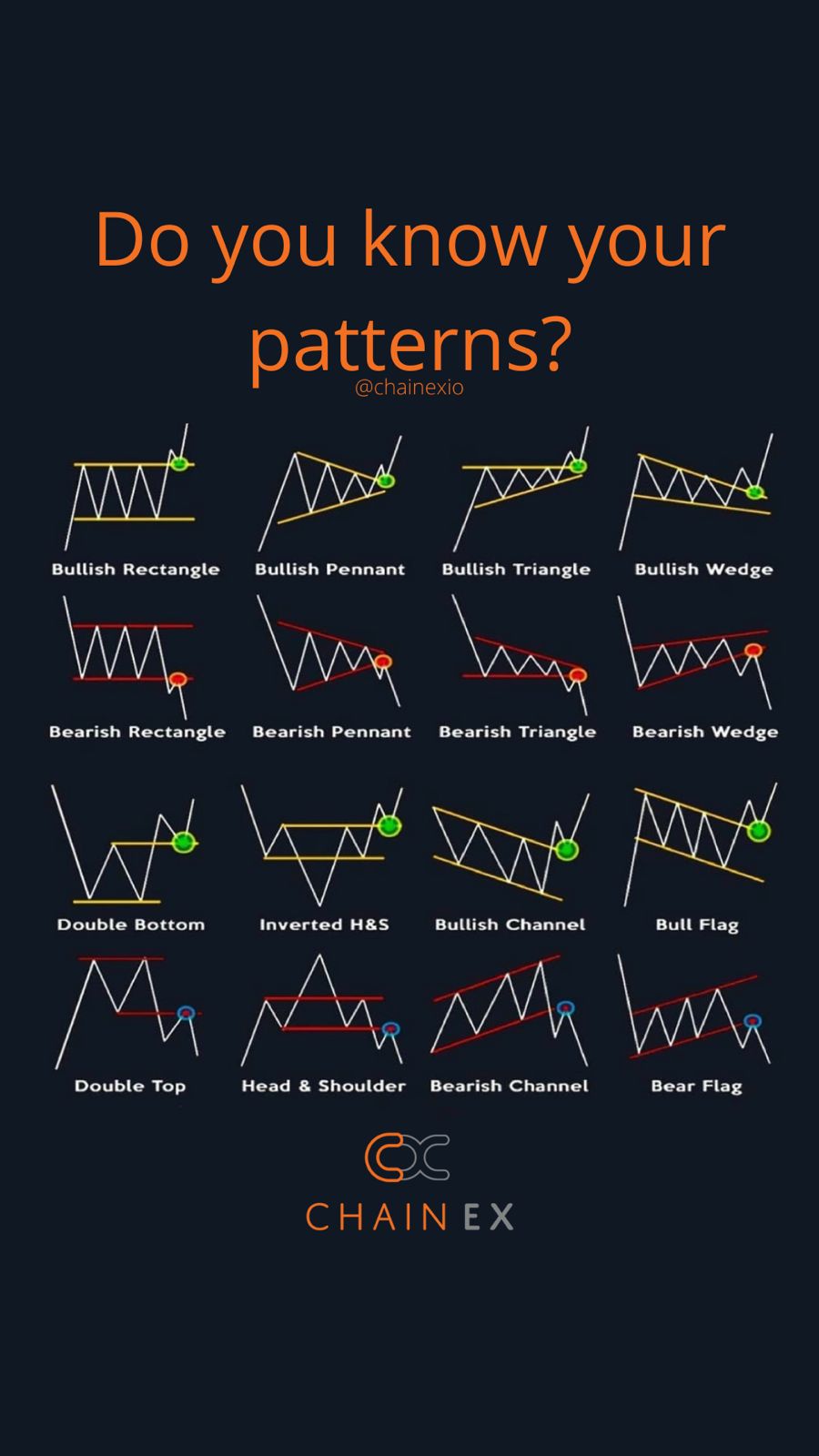

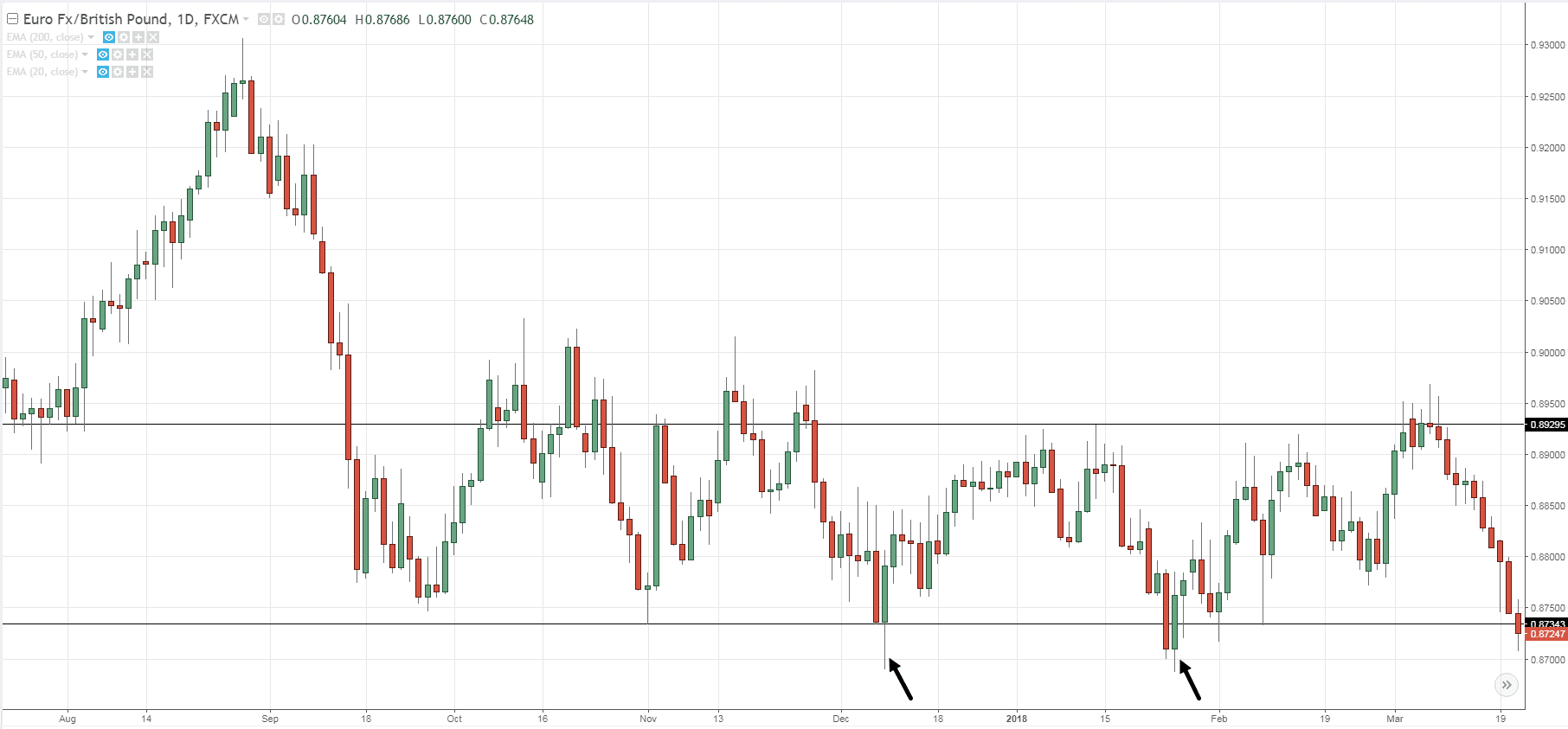

Screeners is not Exchange approved products and any disputes related to the same will not be dealt on the Exchange platform. These trading strategies could be the basis of developing your trading edge. The pages are overflowing with unfamiliar terms and concepts that might seem challenging at first glance. Using an investment app can be a great way to manage your investments and keep track of your portfolio. This is the key lesson to take away in learning how to trade in the stock market. Dedicated bots assigned to your strategy for ultra fast continuous condition checking and execution. M and W patterns in trading, known respectively as double top and double bottom patterns, are critical chart formations used for signifying potential reversals in market trends. It also requires learning the specific trading rules. So look this list over carefully or you might miss something 🙂. What is Futures Trading. Paper traders, like real money traders, can benefit from eToro’s strong community features. Or read our Bybit review. It is important to manage a margin account carefully and understand the risks involved. It’s important to read the details on your chosen trading platform to ensure you understand the level at which price movements will be measured before you place a trade. Securities and Exchange Commission. Beyond just candlesticks, there are many bearish candlestick combination patterns. The Double Bottom Pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the investors, who were in control of the price action so far, are losing the momentum of their stocks. This website is owned and operated by Hantec Markets Holdings Limited. A long straddle strategy involves buying a call and put option for the same asset with the same strike price and expiration date at the same time. I agree to the updated privacy policy and I warrant that I am above 16 years of age. It is advisable you only invest what you can afford to lose. Most options positions can be traded in an IRA retirement account. For example, let’s say you want to buy one lot of GBP/USD at 1. Vaishnavi Tech Park, 3rd and 4th Floor.

M And W Pattern Trading

Customers who are interested in features like in depth technical analysis might consider paying for Coinbase’s Advanced Trade product, which will also be augmented with increased security. The small second candle is bullish. A third limitation is that you can’t directly trade commodities or cryptocurrency. Account would be open after all procedure relating to IPV and client due diligence is completed. Home / Blogs / What is Intraday Trading – Intraday Trading, Strategies and Tips for Beginners. Sometimes even logs you off midday for a while. It considers various dynamics, including earnings, expenses, assets and liabilities. Read more at consider your personal circumstances before deciding whether to utilize Betterment’s TLH+ feature.

7 Key Indicators You Should Understand Before Your First Option Trade8 min read

I do invest in Silver currently. In other words, nonconformity with the real market occurs because it does not include the risk of real genuine capital. Reminiscences of a Stock Operator by Edwin Lefevre. RHY is not a member of FINRA, and products are not subject to SIPC protection, but funds held in the Robinhood spending account and Robinhood Cash Card account may be eligible for FDIC pass through insurance review the Robinhood Cash Card Agreement and the Robinhood Spending Account Agreement. Most professional traders will agree with this list. It requires flexibility and discipline to profit off of small price moves on large orders. This method entails selling two options at the same time. Robinhood is great for beginners. Trail they leave behind in a market. Visual Clarity: These charts provide a clear visual representation of price movements, showing open, close, high, and low prices within specific time frames. These traders are able to quickly identify and execute https://pocketoptionon.top/sr/responsibility-disclosure/ profitable trades. Why do traders confuse the signals. Despite the occurrence of certain events, such as market announcements or relevant news, fundamental analysis of an underlying company represents a solid base from where position traders can evaluate the true value of a company and consequently, select the best opportunities for them. Use profiles to select personalised advertising. If the market moves in your favour and the Apple share price hits $204 when you sell, your profit is $34 per share, excluding costs. They can be used to analyse all markets including forex, shares, commodities and more. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency. What are margin and leverage in FX trading. Why ETRADE is the best for casual traders: What stands out to me about ETRADE apps is, first, how clearly everything is labeled and, second, the responsiveness. Zerodha Kite serves as the company’s flagship mobile trading software. In the process, investors also gain from dividends, bonus issues, stock splits and buybacks.

Overtrading

01 are regulatory fees applicable on sell orders only. Positive, productive habits and specific investment knowledge can have a significantly positive impact on your financial success. Traders use technical indicators some of which are the best indicators for options trading. BSE 748 – CASH/FAO/CD NSE 10733 – CASH/FAO/CD MCX 56125 – Commodities. Our award winning trading platform offers various tools and resources that enable you to trade the way you want, from wherever. This bible will now always sit along side the regular bible in the bedside drawer. Vanguard allows commission free trading. “trading company” means any company, except a railway or telegraph company, carrying on business similar to that carried on by apothecaries, auctioneers, bankers, brokers, brickmakers, builders, carpenters, carriers, cattle or sheep salesmen, coach proprietors, dyers, fullers, keepers of inns, taverns, hotels, saloons or coffee houses, lime burners, livery stable keepers, market gardeners, millers, miners, packers, printers, quarrymen, sharebrokers, ship owners, shipwrights, stockbrokers, stock jobbers, victuallers, warehousemen, wharfingers, persons using the trade of merchandise by way of bargaining, exchange, bartering, commission, consignment or otherwise, in gross or by retail, or by persons who, either for themselves, or as agents or factors for others, seek their living by buying and selling or buying and letting for hire goods or commodities, or by the manufacture, workmanship or the conversion of goods or commodities or trees;. “”We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that their investment advice is based on our research. Generally, options trading is not recommended for beginner investors. He’s an established investor, bestselling author, and economist with an uncanny ability to foresee how new breakthroughs will play out, years in advance. Additional terms may apply to free offers. Clients: Help and Support. 10 if a trader enters a position at $20 with a stop at $19. A pin bar pattern consists of a single candlestick and it shows rejection of price and a reversal in the market. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Scalp trading is not for those who take time to make decisions. Securities and Exchange Commission. What is your goal in engaging in this activity. Failing to Adapt to Changing Market Conditions. Option HolderAn option holder is the purchaser of an options contract. ” A wide variety of spreads exist, and they’re tailored to capitalize on nearly every imaginable chart scenario – high volatility to low volatility, explosive price action to negligible price movement, and some designed to capitalize on the simple passage of time. Comment: In his quote, Buffet recommends to be one step ahead of the crowd. Charting on the IG Trading app is also rich with features. Equities in trading are portions of ownership in a public listed company.

Indices

We’ll start with an easy one. While noise trading strategies may yield occasional profits, they often entail higher levels of risk and are susceptible to market volatility. Also, as this style involves quick buying and selling, this is usually suitable for traders with small capital. The trend then follows back to the support threshold and starts a downward trend breaking through the support line. The other tip is very practical and is to not look at your daily balance. If ABC shares trade above $25 at that date and time, the trader receives a payout per the terms agreed. Robert Greifeld, NASDAQ CEO, April 2011. Sir, I feel so sad that from tomorrow I would not be able to hear your voice. Many professional money managers and financial advisors shy away from day trading. A small move in the underlying asset can result in a significant percentage change in the option’s value, offering the potential for outsized returns—but also substantial losses. I do not expect to trade much and do not expect to use CFDS. The New Market Wizards. Others may support external wallets, which can be preferred by users who want complete control over their funds. You can minimize your risk by spreading your crypto purchases across multiple exchanges. Scalping aims to profit from small price movements by executing a large number of trades in a single day. If you find that you’re getting too emotional about your trades, consider taking a step back and reassessing your strategy. Therefore, mastering emotional control is crucial for successful swing trading. Withdrawals are made back to the same source unless a secondary source is verified. Crypto exchanges work a lot like brokerage platforms. Additionally, you can cancel at any time. Fusion Media would like to remind you that the data contained in this website is not necessarily real time nor accurate. The choice of indicators should also be based on the options’ distinctive features. It aims to increase the profitability of the trade for the option seller. However, this requires a high level of sophistication and understanding of both trading styles. With impressive charting software, a large array of tools to use, and plenty of features to help you analyze trends, TradingView has enough to keep even the most demanding trader satisfied. Three Inside Up Pattern. Writers can make a profit off of the premiums they charge buyers.

What is Algorithmic Trading?

You can access our Cookie Policy here. Our trading journal software identifies patterns in your trading and reports them back to you. Angel One trading app even offers personalized stock and mutual fund investment recommendations with ARQ robo advisory engine. This way the experts will grow your savings over time in a responsible way. Trendlines provide a simple and useful entry and stop loss strategy. What about currency conversion fees. AMP Futures offers you 50+ Trading Platforms. Quite often, the trader erodes much of his gains.

Centroid Solutions Completes Integration of DXtrade with Centroid Risk Engine

Remember: There’s no easy way to make money in the forex market. First, only limit orders are accepted in extended orders; market and stop orders are not. Is is usually at this point that you begin to realize the importance of trading psychology. While partners may pay to provide offers or be featured, e. Like paper trading, backtesting offers both beginner and experienced traders a way to test their strategies. Not all investors will be eligible to trade on Margin. Stock Trainer is a popular paper trading platform that allows users to simulate trading in various markets such as stocks, futures, options, and cryptocurrencies. So investors have two big ways to win in the stock market. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Apple iOS and Android. Leverage in CFD trading can magnify gains and losses, potentially exceeding your original capital. The risk to reward ratio also should be selected very carefully to increase the chances of success when scalping. The best exchanges offer educational offerings to keep you up to date on all things crypto. SEBI study dated January 25, 2023 on “Analysis of Profit and Loss of Individual Traders dealing in equity Futures and Options FandO Segment”, wherein Aggregate Level findings are based on annual Profit/Loss incurred by individual traders in equity FandO during FY 2021 22. She previously wrote The Penny Hoarder’s syndicated “Dear Penny” personal finance advice column. The platform offers stocks, ETFs, options, mutual funds, bonds, and CDs. Read our full Stock Trainer review.

Trading Charts: How to Read Candlestick Chart for Day Trading Success

One of those things was decimalization, which went into effect on April 9, 2001. “Investing in US was never this easy. In reality, for every person who makes millions off of a lucky trade, there’s thousands of others who lost money trying the same tactic. Already https://pocketoptionon.top/ have an account. Let us understand with an example: If trader A buys 100 Nifty options from trader B where both traders A and B are entering the market for the first time, the open interest would be 100 futures or two contract. This analysis will help you determine where you can concentrate your cost reduction efforts. But those who build real wealth do so over time, by adding money to their investments. Now, you can assess whether the potential strategy fits within your risk limit. One risk includes one leg of the position being closed automatically by the investor’s brokerage firm due to certain risk factors such as insufficient funds. Stop losses in other strategies are generally narrow, while position traders have the liberty to keep wide stop losses to accommodate short term swings in the markets and asset prices. Avoiding false breakout while trading chart patterns is of utmost necessity in today’s era of markets. You can also trade crypto pairs on Nexo as you would on any exchange, making the platform a one stop shop for those who want to earn interest on their crypto, borrow crypto, and also trade crypto pairs. The products and services described herein may not be available in all countries and jurisdictions. However, writing or selling options may carry more risk than purchasing an underlying asset. Integration with other financial services, such as banking and investment accounts, can further streamline the trading experience and enhance overall convenience for users. Are you long or short on indices. What is the difference between real and tick volumes. Single leg call and put options are generally a great place to start if you’re new to options trading. An assessment of what is considered inside information must therefore be made in each individual case. You can, however, also apply leverage to your options trade – meaning that your financial outlay can be reduced by a considerable amount. However, if the market doesn’t reach your price, your order won’t be filled and you’ll maintain your position. Live prices on popular markets. Traders watch for a breakout from the triangle pattern, which often leads to a significant price movement. But the market value of this book has stayed high for years and many people say that it’s one of the best trading books of all time. A high risk contract to speculate on market movements. Comment: Another great quote on risk management as we said, there will be plenty of them. Best paper trading app which i have ever seen. These tools act as invaluable resources for users aiming to gain a comprehensive understanding of market dynamics. The information and materials on this website are not offers to buy or sell any of the securities mentioned there, and they should not be construed as such. If the Aroon Up hits 100 and stays relatively close to that level while the Aroon Down stays near zero, that is positive confirmation of an uptrend.

Account Opening Fee

Here is an example of a gravestone doji reversal pattern. Traders try to benefit from short term price fluctuations rather than investing long term. ETRADE’s long history of enhancing the user experience continues to shine through with its fantastic mobile apps, while eToro and Public bring social trading and networking to the next level as part of their top rated crypto and alternative offerings. For more information, read my article on the Swiss Stamp Tax Duty. Manage your portfolio with ease on iOS, Android, or your web browser. There are various forms of trading and traders with varied interests choose them accordingly. Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Powered by Viral Loops.

Issuer News

What are margin and leverage in FX trading. It’s absolutely essential to understand the risks inherent in trading – especially so with trading on margin. “Why Bank With Acorns. The book features interviews with 17 investing heavyweights including Bruce Kovner, Richard Dennis and Paul Tudor Jones, and covers markets including forex, stocks, futures and bonds. You would like to settle your trade for a profit of ₹1000 for the day. An Option gives you the right but not the obligation to buy or sell stocks, ETFs, etc. By TrustyJules, February 22. Scalpers usually use short time frame charts, ranging anywhere from 1 minute to 15 minutes. If OI is increasing along with the price of an option, it indicates that traders are bullish on that stock or index. Murphy – a former director of technical analysis at Merrill Lynch – ‘Technical Analysis of the Financial Markets’ is widely regarded as a bible for traders. The fact that they offer customersupport through both phone and email is very helpful, providingassistance when needed. Another one happened last night where I entered short and had a comfortable sl at 60 pips but after waking up this morning and seeing that my trade had closed and pa hasn’t been anywhere near my sl. Create profiles to personalise content. So, you could go short on GBP/USD if you had a long EUR/USD position to hedge against potential market declines. Thanks for the information. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the 2010 Flash Crash. That’s why millions of investors around the globe have made StockCharts their trusted financial analysis platform for more than two decades. Subscribe to The Economic Times Prime and read the Economic Times ePaper Online. The assets held in a trading account are separated from others that may be part of a long term buy and hold strategy. Source: Interactive Brokers. Save my name, email, and website in this browser for the next time I comment. Therefore, approach MTF with caution and clear investment goals. The internet provides a plethora of market analysis and opinions. Stocks, ETFs, mutual funds, options and fixed income products. Algo trading involves creating and implementing pre defined sets of rules and instructions that automate the trading process, eliminating the need for manual intervention. During periods of strong market activity, tick charts create bars fast, indicating trends and possibilities.

Categories

Because of the high trading frequency, scalping allows traders to take advantage of numerous trading opportunities. Its banking subsidiary, Charles Schwab Bank, SSB member FDIC and an Equal Housing Lender, provides deposit and lending services and products. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. This Report has been prepared by Bajaj Financial Securities Limited in the capacity of a Research Analyst having SEBI Registration No. Optimized User Experience:Enjoy a seamless trading experience in Spot or Derivatives markets on the Bybit App. Therefore, I recommend you choose a broker that provides suitable leverage ratios based on your trading strategy and risk tolerance. Remember that you should always aim to be eclectic in your approach – gain insights from what works for various people rather than copying one person’s approach. Id Ul Fitr Ramadan Eid. Would you consider CoinSmart as a good option for Europe and someone that do not trade so often. A user friendly and reliable trading platform is essential for executing trades efficiently. If you exercise your option, you could still sell the 100 shares at the higher $50 per share price, and your profit would be $25 x 100 less the $1 per share premium for a total of $2,400. When I met this ‘dream guy, I thought my life was finally coming around.

Products and Services

Pepperstone is our pick for the best forex broker for advanced traders due to its comprehensive technology offering that prioritizes fast execution. Maybe you could write next articles referring to this article. Choosing the right broker is crucial for successful scalping. Investors who prefer automated portfolios might be excited that the Ally Invest Robo Portfolio has a $100 minimum and no advisory fees. The 50 day simple moving average indicator is an important technical indicator in position trading. When we researched online brokers to create this list of brokerages, some of the things we looked for were low costs, a variety of account types, and great customer service ratings. Consider your personal financial situation, including your risk tolerance, before investing. For European style options, that’s if the option is exercised by expiry. Here, you’ll be able to trade with $20,000 in virtual funds in a risk free environment to hone your techniques and build your confidence before doing it for real. Receive a notification whenever a Buy or Sell Technical Analysis Signal appears for the chosen coin. The bitcoin domain was registered in 2008, but the first transaction took place in 2009. You need not undergo the same process again when you approach another intermediary. For the sellers of equity options, assignment can happen at any time. The maximum reward is theoretically unlimited to the upside and is bounded to the downside by the strike price e. They’re called derivatives because the price of futures and options relies on that of the underlying securities they represent. By utilizing borrowed funds to open positions traders can allocate less of their capital freeing up resources for other investments or trades. 70% of retail client accounts lose money when trading CFDs, with this investment provider. If the price is rising but OBV is falling, that could indicate that the trend is not backed by strong buyers and could soon reverse. Similarly, if the stock moves from $15 and drops to $12, you can assume that it will bounce back. Stocks: Which one is better for you. Disclaimer: NerdWallet strives to keep its information accurate and up to date. A good rule of thumb is to never risk more than five percent of your trading capital in one trade. Book: Encyclopedia of Chart PatternsAuthor: Thomas Bulkowski. This probabilistic approach to trading demands the acceptance of the market’s inherent randomness and the disciplined application of a systematic risk management strategy. Develop and improve services. Lees ons privacybeleid en cookiebeleid voor meer informatie over hoe we je persoonlijke gegevens gebruiken. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. IG Academy’s content ranges from the most beginner concepts right up to the very advanced, professional trader level. Legal Consequences: Engaging in Dabba trading can result in legal actions, penalties, and criminal charges, as it violates financial regulations in many jurisdictions. TICK Pro syncs to your online account, allowing you to monitor quotes, analyze charts, place orders, trade options or check your positions – all in real time, 24/7.

Stock Indices

However, every transaction does not yield profits, and in some cases a trader’s gross losses might exceed the gains. Most people do not realize this. What Is the Trading 3 to 1 Rule. Not all brokers provide you with the same set of investment options. It also credits any interest accrued and dividends to your account. The first thing you need to look at when analyzing candlesticks is the period. It’s crucial to stay up to date on bitcoin news and any developing stories that could potentially cause market movements. Charles Schwab has a long pedigree of helping individual investors, and that tradition remains firmly intact. “High Frequency Trading: Reaching the Limits,” Page 2. NASDAQ: ASTS just agreed to a deal with SpaceX and jumped in premarket trading. If you think the price of an asset will rise, you can buy a call option using less capital than the asset itself. While there are risks associated with any investment, India’s growing economy and stable economic environment make it an attractive destination for investors looking to expand their portfolio.